How to Use Machine Learning and AI in Fraud Detection

Timely fraud prevention, detection, and neutralization are the most complicated challenges for e-commerce, banking, or other fintech business. Attackers cause not only financial but also reputational damage.

Machine learning is considered one of the most promising protection tools against fraud. Today, it’s used in many areas, from detecting spam emails to content recommendation algorithms on Netflix. AI is gaining access to vast amounts of data and is improving at a breakneck pace.

So, let's talk about fraud prevention using machine learning. In this article, we will consider the main fraudulent schemes, ways to fight them with AI and ML algorithms, and real examples of such technologies’ implementation.

What Is Fraud Detection?

Fraud detection is a set of measures, analyses, and processes to prevent the receipt of money, property, personal data, or any benefits through a false pretext. Fraud detection techniques are used in all areas where people deal with goods. For example, it can be the financial sector, insurance, medicine, etc.

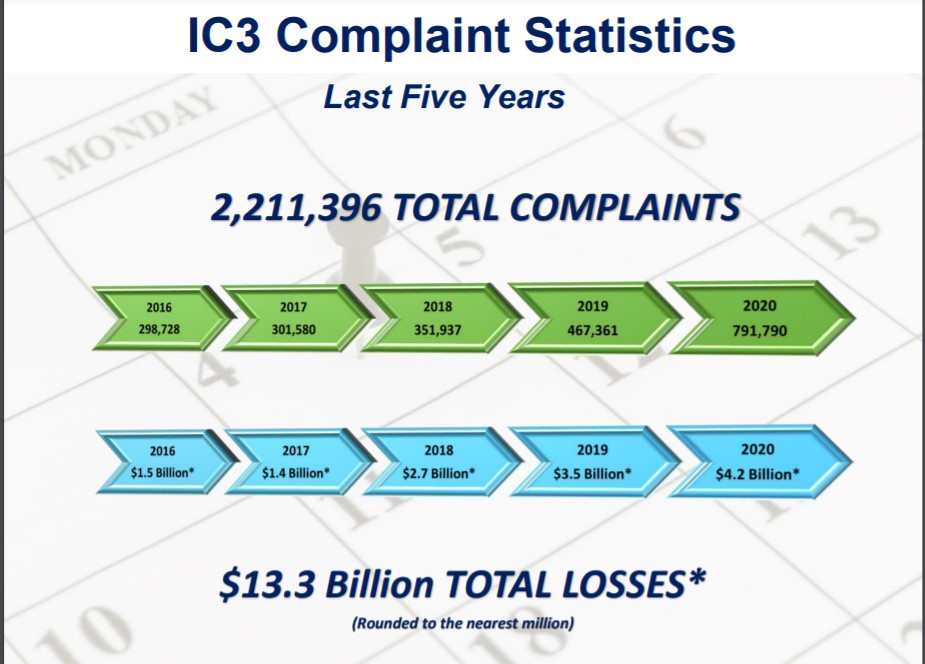

According to the 2020 Internet Crime Report, the number of complaints of suspected internet crime increased by more than 300,000 complaints from 2019 to 2020. Reported losses exceeding $4.2 billion. And this is the only data that the FBI has from the US victims.

So fraud protection system is a must for any type of business. And it’s better to find the most efficient way of detection.

Benefits of Using ML and AI in Fraud Detection

Machine learning algorithms can learn from every historical fraud model that has ever existed in the world. Moreover, AI can process this data with incredible speed. Given that, fraud detection using machine learning has the following benefits:

- High speed. Machine learning algorithms check operations and detect unsanctioned ones much faster than any human. The process takes a few minutes or even seconds, while an analysis by a person may take days.

- Efficiency. Machines can analyze thousands of fraudulent patterns and detect insidious signs or specific fraud features that people wouldn’t even notice. In addition, while AI performs routine tasks and analyzes data, staff have time to work on more complex decisions.

- Scalability and constant development. ML methods are becoming more productive with the expansion of data workloads. The larger the fraud patterns’ set scale, the better machine learns. AI constantly discovers new fraudulent methods and evolves with them, if not faster. Unfortunately, human isn’t capable of this.

For all those reasons, machine learning fraud detection is the best way to protect any system. AI significantly reduces the risks for business and helps it survive in the brutal world of cyberfraud.

How Does a Machine Learning System Work for Fraud Detection?

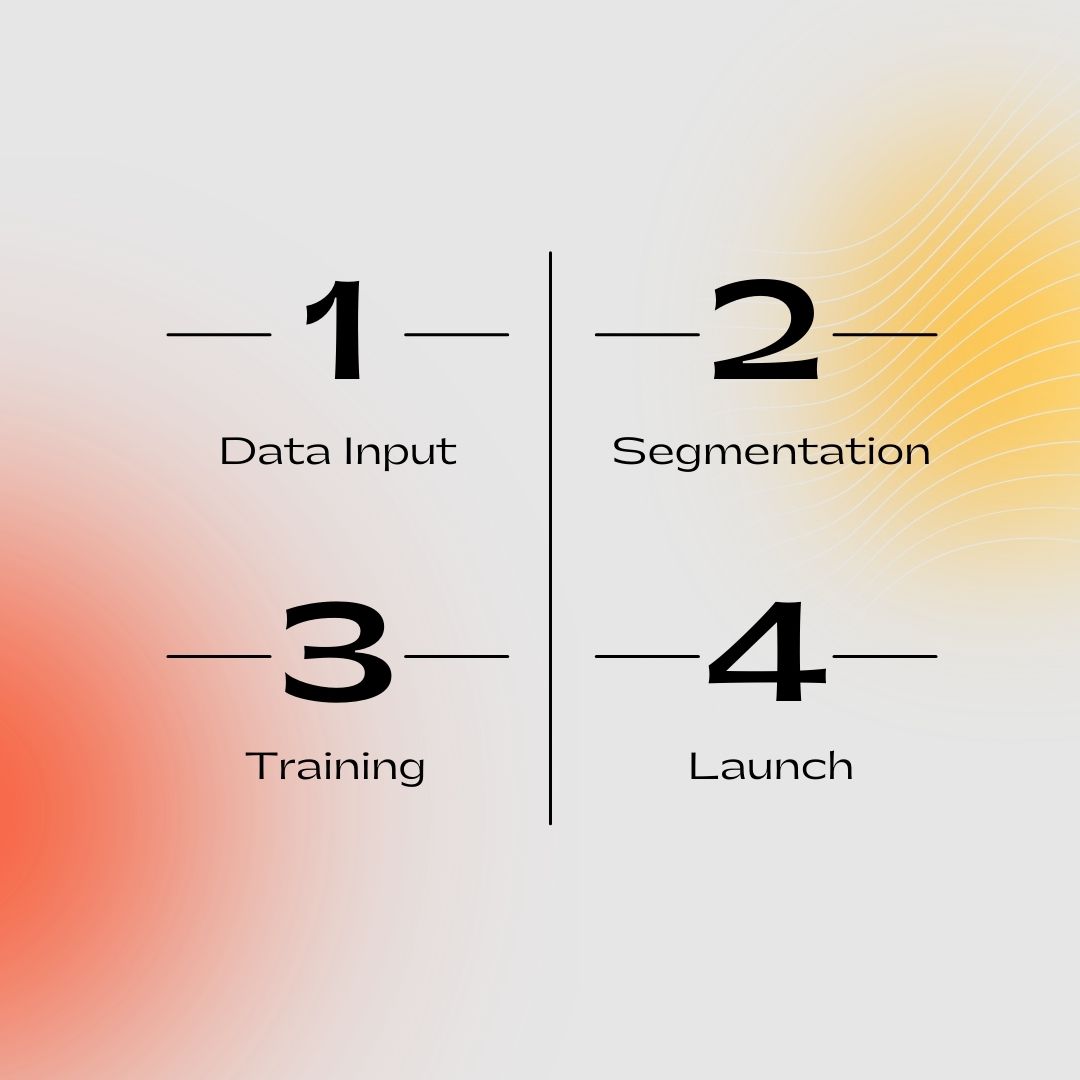

Any machine learning model goes through several stages to detect fraud. The simplified scheme of the process looks like this:

- Phase 1. Data input. To begin with, the ML model must obtain data for further training. The more data, the greater the chance that the machine will be able to detect the least visible and sophisticated methods of fraud. Unlike humans, AI processes giant arrays of information in a matter of days, so in the first stage, developers try to provide the model with the maximum amount of data.

- Phase 2. Segmentation and features adding. At this stage, AI has enough data but can’t analyze it yet. Therefore, developers are adding features that could describe the fraudsters' behavior and the correct pattern of customer action. This feature set includes clients' locations, identities, payment methods, frequent transactions, etc. The list is quite large and may vary depending on the complexity of the fraud detection system.

- Phase 3. Training algorithms launch. Here, the model receives a set of rules that helps decide whether the transaction/process/action was sanctioned or fraudulent.

- Phase 4. Completion of training and launch. Another step is the implementation of the model into the customer's system. The machine analyzes all events/transactions/actions in the system and detects fraud based on previously obtained patterns. The model goes through all the collected data, segments it, and then extracts the particular features from the set. After this, it applies training algorithms to detect fraud.

Any machine learning model needs maintenance and upgrades. So the developers check it and add new features from time to time.

8 Common Types of Fraud

One article is not enough to describe all the existing types of fraud. The list of new sophisticated deception methods is constantly updated. However, there are some of the most common options.

Email Phishing

Email phishing is a type of fraud involving obtaining users' personal information by disseminating fake websites or messages. In most cases, the phishing scheme looks like this:

- An e-mail with a dangerous link arrives.

- The user follows this link to the site and inputs confidential data in the fake access window.

- Fraudsters obtain this data and use it for loans, blackmail, etc.

Fake sites can look like the official websites of banks, financial institutions, etc. The message may ask for details for bank checking or other needs. Thus, inexperienced users put their personal data in fraudsters’ hands.

The best way to protect yourself from phishing is to ignore such e-mails. Unfortunately, not all users have enough experience and carefully check the received letters. Moreover, such fraud is especially damaging to businesses, as employees can share not only their personal data but also confidential corporate information.

To combat phishing, companies use machine learning methods for filtering and regression and the authentication protection system.

Payment Fraud

Payment fraud is one of the most common types of cybercrime. Most often, attackers use lost or counterfeit credit cards. The scammers first collect data for hacking into bank accounts or e-wallets. Phishing, as mentioned above, helps to obtain information. Sometimes scammers buy entire databases on the darknet.

After receiving personal data, attackers will hack the victim’s bank account, change the email address and phone number so that the owner doesn’t receive notifications about transactions and actions. Scammers can open new credit cards and manage the user's funds.

They also typically take loans in the name of their victim.AI is especially effective in payment fraud detection. It analyzes the user's actions and compares them with the usual behavior pattern. As a result, the machine detects even the smallest details that may indicate possible illegal activities.

Bank Account Takeover Fraud

In this case, the attacker tries to access the victim's bank account using malicious software or basic phishing. Additionally, fraudsters can hack into a victim's social media to ask friends and relatives to transfer money.

Scammers can also get users' logins and passwords through fake sites. People often use the same login information when signing up on different platforms. That’s why it’s enough to enter data once on a malicious site so that fraudsters can use it for bank account takeover.

An attacker can also pretend to be a bank employee and try to obtain a login account by phone. He or she only needs to access e-mail to "restore access to the account" and steal it.

Again, machine learning algorithms can automatically track all user actions and detect suspicious behavior patterns. They also monitor location, verify contact information, etc. While human needs some time to check and detect such fraud, the AI can find an illegal intrusion within minutes.

Identity Theft

Identity theft brings enormous damage to both individuals and companies. In this case, the attackers gain access to all victim’s personal data: bank info, e-mail, passwords, passport and identification data, etc.

There are two main schemes of identity fraud. The first one is the theft of real identity, where the victim's name and all data are used to gain access to existing accounts and e-wallets. The second one is creating a synthetic person, where true personal data are combined with fictional ones to create a non-existent person. Fraudsters open credit cards and bank accounts, take loans, make purchases, etc. At the same time, all debts are placed on the victim's name whose personal data was stolen.

Identity theft can result in increased debts, blocked bank accounts, and demands to pay bills for services the victim didn’t receive. In the case of companies, attackers may impersonate employees to gain access to confidential information through their accounts.

Machine learning algorithms as a fraud detection solution provide real-time validation of documents, comparing them with information from secure databases. It helps detect any changes and requires additional verification, such as biometric authentication.

Document Forgery

Just what it sounds like, document forgery involves using fake IDs or other documents for various purposes. It can be scams with real estate, loans, even corporate espionage.

Modern fake documents look very similar to real ones; they may even have proper QR-codes and watermarks. Unfortunately, neither a person nor an automatic identity verification system is able to detect such a forgery immediately.

AI effectively deals with such fraud due to access to large databases and the ability to analyze them quickly. It scans the document, goes through all the known examples of fakes, and finds matches. The machine may request additional verification or biometric authentication if such details are found.

Fake Applications

Fake apps can look exactly the same as popular applications downloaded from the App Store or Play Market. At best, the victim simply pays for the program but doesn’t receive any functionality. In this situation, it’s enough to delete the app if it’s a fake. However, in most cases, everything is much worse.

Fraud applications may contain malicious software. After downloading to the device, it steals personal data, passwords, etc., and passes it directly into the hands of attackers. Also, a lot of unauthorized advertising could be downloaded together with the application.

To detect such applications, artificial intelligence checks the developer and all available information about the program. In the case of fraud, it may block the downloading.

Healthcare Fraud

Health fraud also damages individuals and entire companies whose work involves providing medical services. According to FBI reports, such crimes can be committed by patients, medical or health care providers, as well as those who seek illegal compensation or payment.

Health fraud committed by individuals includes identity theft (using another person's insurance or prescriptions), bogus marketing (stealing of health insurance identification number to bill for non-rendered services), stealing a health care professional identity, or providing medical services without a license.

Health fraud committed by health care providers includes double billing, submitting multiple bills for the same service, for a more expensive service than the patient actually received, or even for services that the patient never received. This fraud also relates to creating/using fake prescriptions, creating legal prescriptions for illegal uses, etc.

In this case, machine learning for fraud prevention can analyze insurance data, prescriptions and bills to find fake ones or detect illegal use.

Stolen Tax Refund Fraud

This type of fraud is based on stealing the identity of taxpayers to create fake tax returns and get a refund. It is enough for the attacker to get a social security number and name. This information is required to file an early return with a claim for a refund. When a real person tries to submit the tax return, it’s simply rejected.

Since the core element of stolen tax refund fraud is the social security number, thieves create new schemes for obtaining it all the time. Most often, they pretend to be IRS agents or bank clerks. Fraudsters ask to specify the number of social insurance by phone or e-mail. Scammers can also hack an entire company's database to gain employees' SSN.

Credit Card Fraud Detection with Machine Learning

According to the Merchant Savvy statistics, global losses from payment and credit card fraud have tripled from $9.84 billion in 2011 to $32.39 in 2020. Furthermore, experts suggest that the numbers will increase to $40.62 billion in 2027. Organizations conduct investigations after the attacks to fight financial fraud, and it helps to improve safety. The data obtained during the inquiry allows us to find new patterns for machine learning.

With the transition of payments to digital format, users input credit card data everywhere online. On the one hand, it speeds up financial processes and improves the user experience, but on the other hand, it makes fintech companies and their customers more vulnerable. If fraudsters gain access to credit card information, it affects not only the security of an individual but also the entire company's reputation.

Therefore, credit card fraud detection is essential for every fintech security system. It’s better to know your enemy by sight to fight him successfully. So let’s talk about the most common type of credit card fraud:

- Account Takeover. We have already talked about this method of financial fraud above. The attackers gain access to the victim's bank account, then use credit cards or order new ones in the victim's name.

- Formjacking. In this case, fraudsters use malware to intercept data from low-quality sites. If the online store or application has vulnerabilities in the code, the credit card details entered for online payment immediately fall into the hands of attackers.

- Intercepting cards through emails. Fraudsters hack into the victim's mailbox and use letters with bank information to access credit cards.

Why is machine learning the most effective way of protection in such cases? Learning algorithms allow AI to know absolutely everything about all known card fraud schemes. Every tiniest detail is available for analysis. Due to this, the machine detects unusual behavior, change of location, third parties' intrusion into the account much faster than a person or any other system.

Attackers often change the phone number and email address in the victim's account. Bank employees may not pay attention to this, but the AI will be sure to notice such changes, analyze the changed data and report suspicious behavior.

Machine Learning Models and Algorithms for Fraud Detection

There are four fraud detection machine learning models that are used for fraud detection. The choice of a particular type depends on the software features, its architecture and scope of use.

Unsupervised Learning

The unsupervised learning model operates and analyzes new data constantly. This solution is most often used in cases where there is very little data about actions and transactions. The model updates and detects abnormal activities due to the constant information processing. By the way, the algorithms for fraud detection in deep learning are often unsupervised.

Semi-supervised Learning

A semi-supervised learning model works with both unlabeled examples labeled ones. This option is quite complex because uncontrolled and controlled algorithms can’t effectively use mixed data sets. Therefore, expert control is required for correct operation.

Supervised Learning

Fraud detection machine learning algorithms with supervised learning are the most popular option in fintech. In this case, all input data is marked as "bad" or "good". This model is based on predictable information analysis using a training kit. The training lasts until AI begins to detect specific patterns between the input data set and the output labels. Such algorithms are excellent for solving classification problems and data understanding in the context of particular issues.

Reinforcement Learning

The reinforcement learning model continuously analyzes the environment and learns from it to identify actions that would increase the chances of a reward and reduce risks. Feedback allows the AI to evaluate its behavior and make adjustments. Thus, the machine detects ideal behavior in relation to a particular context.

Fraud Detection With ML: Case Study

Our financial management SaaS tool for courier companies is an example of a use case in fraud detection. We’ve developed a convenient app to simplify financial and docs routines for both employees and company head management. So users could raise and fully manage invoices, upload supplementary documents, and add credit card and bank details or finance provider bank details.

As it has such features as invoice export, document reconciliation, PODs management and payments, we had to protect all the processes from fraud. So the best option, in this case, was to implement the supervising machine learning model for analysis of all users’ actions, behavior and locations.

Sum Up

So, summing up, a fraud detection system using AI and ML algorithms is a must for every modern fintech app. It’s the future of the fraud prevention industry and one of the most efficient ways to build a solid security system. There are a lot of types of internet fraud. Developers use unsupervised, semi-supervised, supervised and reinforcement machine learning models to fight them. The choice of this system depends on the software type, purpose, architecture and other critical features.

We have real experience developing save fintech apps using ML algorithms, so if you have any questions, feel free to contact us in any convenient way.